Looking for help? Contact our Help & Support Team

- Home »

- Country summary »

-

Austria

Austria

Looking to conquer the world of business without getting tangled up in international employment complexities? We got this.

No cultural barrier or legal obstacle will stand in your way with us in your corner. We tailor our services to fit your unique needs so you shine no matter where you operate in the world.

Creating a worldwide workforce is a continuous process that extends beyond a contract.

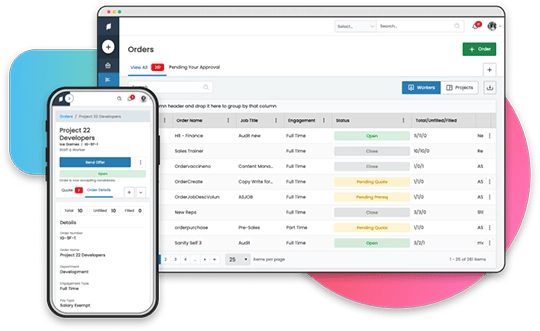

TCWGlobal surpasses the typical employer of record (EOR) by ensuring that your team receives personalized attention, ranging from smooth payrolling management to customized benefits based on your specific needs and location.

Historically, individuals were classified as Workers (e.g. blue-collar) or employees (e.g. white collar). In the present day, there is little difference between the two from an employment law perspective. Senior managers are occasionally exempt from certain labor laws and CBAs.

In Austria, fixed-term contracts are permitted and may only be used in limited situations and must have a clearly defined termination date. Fixed term contracts must be for a minimum of six months and a maximum of five years. No renewals are permitted. Fixed term contracts can only be terminated before the agreed expiration for cause or by mutual agreement.

Except as it relates to apprentices, probationary periods cannot be longer than one month. During a probationary period, either the Worker or the employer can terminate the agreement without a reason.

In Austria, Workers recognize 13 paid public holidays. Unless otherwise dictated by CBA, work performed on a public holiday should be compensated at double pay.

Workers on a five-day workweek are entitled to 25 days of paid vacation annually (30 for Workers on a six-day workweek). Accrued but unused leave carries over year to year for a maximum of two years. Upon termination, unused vacation shall be paid as an allowance in lieu of taking annual leave.

Workers are entitled to full salary for up to six weeks during a period of injury or illness. The entitlement increases to eight weeks after one year of service. After that period is exhausted, Workers are entitled to an additional four weeks of half-pay.

Unless otherwise stipulated or dictated by collective agreement, work in excess of normal working hours should be compensated at 150% of wages (200% in cases of night work or Sunday work). Overtime must not exceed 12 hours per day or 20 hours per week. Workers may refuse overtime in some instances.

Workers receive 13th and 14th month bonuses, each equal to one month's wages. The former is generally issued in June and the latter in December.

Except in cases of misconduct, terminating a Worker requires notice and, in some cases, severance. The notice required depends on the length of service. Workers wit two years of service or less are entitled to six weeks' notice. Workers with more than two but less than five year of service are entitle to two months' notice. Good cause must also be provided for termination of protected Workers (e.g. pregnant Workers, parents on parental leave, disabled persons, etc.). Collective dismissals require notification to the Austrian Employment Service no later than 30 days in advance. Employers must notify the labor branch of the public employment services (AMS) if they intend to dismiss a group of Workers if their total employee count meets a certain threshold. Failure to inform the AMS could result in the dismissal being deemed unlawful.

Workers must give at leave one months' notice of resignation regardless of their length of service. The parties can contract to increase the notice period up to six months.

Employers must notify the labor brand of the public employment services (AMS) if they intend to dismiss a group of Workers if their total employee count meets a certain threshold. Failure to inform the AMS could result in the dismissal being deemed unlawful.

Generally, Workers are entitled a contribution to their social insurance (appx. 21%), a pension fund (appx. 1.5%), and a family equalization fund (appx. 4%). Municipal tax (3%) must also be paid as a contribution.

TCWGlobal stands unmatched as the leading employer of record service provider. Our global reach, expertise in diverse industries, and commitment to client satisfaction makes us the best choice. Looking for a global employer of record or international payrolling partner that will work with you and not for you? Trust TCWGlobal. We are here for you.

When choosing an Employer of Record (EOR) service, people often make mistakes such as overlooking compliance, global reach, technology integration, company experience, and fee transparency. Watch this video to see what to consider when picking an EOR.

Unleash global talent with our hassle-free payrolling and staffing services.

Tap into global talent effortlessly. As the employer of record, we handle liability, governance, and compliance. Say goodbye to administrative burdens. Contact us now.