Looking for help? Contact our Help & Support Team

- Home »

-

Eor

Eor

An Employer of Record (EOR) collaboration combines specialized employment administration with your operational expertise. This partnership addresses aspects like payroll, taxes, benefits, and labor law considerations while your team maintains direction of day-to-day activities.

Working together creates opportunities to enter new markets through streamlined processes. The arrangement allows focus on core business priorities while supporting effective workforce management through shared attention to local requirements.

An Employer of Record (EOR) collaboration establishes a shared framework where the EOR serves as the legal employer in specific domestic or international locations. This partnership addresses legal, administrative, and compliance-related aspects of workforce engagement while respecting operational independence.

The arrangement particularly benefits organizations exploring market expansion or remote work across regions without establishing separate legal entities. Working together enables attention to regional labor laws, tax requirements, employment contracts, and benefits administration through combined expertise.

This collaborative approach coordinates essential employment practices that vary between countries and regions. A structured partnership helps address regulatory requirements and compliance obligations through shared attention to tax laws, employment contracts, benefits, and other local considerations.

The relationship allows each party to focus on core strengths - whether business development, sales, strategic growth, or employment administration. This model supports global workforce management while acknowledging regional requirements in today's competitive market.

An Employer of Record (EOR) arrangement combines expertise in employment management services, including payroll processing, tax administration, and benefits coordination. The partnership addresses workforce responsibilities through shared attention to salary processing, tax calculations, withholdings, and local tax law requirements.

Together, this approach coordinates employee benefits programs - from health insurance and retirement plans to additional offerings - while aligning with local regulations and market standards.

The collaboration brings together knowledge of labor laws, employment contracts, and workplace safety standards. Regular exchange of insights about regulatory changes helps address compliance requirements across regions.

HR teams from both organizations work jointly on workforce needs, including onboarding, termination processes, and dispute resolution. This coordinated approach supports consistent practices while adapting to location-specific considerations.

Through mutual focus on respective strengths, the partnership enables attention to both strategic growth and employment administration, creating effective workforce structures across locations.

An Employer of Record and a Professional Employer Organization both assist businesses with workforce management, but their roles and responsibilities differ. An Employer of Record works alongside companies to provide support as the legal employer for their workforce, managing payroll, taxes, benefits, and compliance with local labor laws. This approach is not only ideal for businesses looking to expand globally but also for managing contingent workers or workers located in different regions, even within the same country. The Employer of Record provides assistance to ensure compliance and simplifies workforce management across various locations.

On the other hand, a PEO typically supports a company’s entire workforce under a co-employment model, sharing responsibilities and liabilities. While the PEO handles HR functions like payroll, benefits, and insurance coverage, the client company remains the legal employer and must have a legal entity in the country where the workers are located. This model is typically used within a single country where the business is already established and looking to outsource HR functions to focus on core business activities.

In summary, an Employer of Record is ideal for managing contingent or geographically dispersed workers, providing tailored compliance and employment solutions, while a PEO tends to support the entire workforce, requiring the business to maintain a local legal presence.

An Employer of Record (EOR) collaboration brings together expertise in the essentials - we're talking payroll, taxes, benefits, and those all-important local labor laws. Think of it as a dynamic duo that enables hiring across borders (both international and domestic) without getting tangled in local entity red tape. This partnership particularly shines when managing contingent workers or teams spread across different locations.

Now, staffing agencies? They're the matchmakers of the business world. Their focus is connecting companies with temporary or contract talent, handling everything from talent scouting and interviews to the actual hire. While they manage their own payroll and HR responsibilities, they're typically in it for the short game - think project sprints and temporary staffing solutions rather than long-term relationships.

Bottom line: EOR partnerships tackle the comprehensive legal employment landscape, especially for those thinking long-term or dreaming global, while staffing agencies excel at finding those perfect temporary matches for your immediate needs. Different strokes for different workforce folks!

An EOR collaboration combines expertise in employment fundamentals - from payroll and tax administration to benefits coordination and labor law requirements. This partnership enables workforce engagement across domestic and international locations without establishing separate entities, while maintaining your operational direction over daily activities.

AOR relationships specialize in different territory - focusing on independent contractor and freelancer arrangements. These partnerships coordinate contract administration, payment processes, and compliance considerations specific to contractor relationships. Unlike the broader employment scope of EOR arrangements, AOR collaboration maintains appropriate contractor distinctions while supporting compliant engagement practices.

Think of it this way: EOR partnerships help navigate the full employment landscape, while AOR relationships focus on keeping contractor connections clear and compliant. Each model serves distinct workforce needs while respecting proper classification boundaries.

TCWGlobal stands unmatched as the leading employer of record service provider. Our global reach, expertise in diverse industries, and commitment to client satisfaction makes us the best choice. Looking for a global employer of record provider that will work with you and not for you? Trust TCWGlobal. We are here for you.

Partner with a Global Employment Solutions Expert: Your Strategic Co-Pilot in Workforce Compliance

As your dedicated Employer of Record (EOR), we forge collaborative partnerships that empower businesses to expand confidently across borders. Through shared responsibility and mutual commitment, we navigate the intricate landscape of global employment together.

Our expertise complements your business acumen:

While we provide the infrastructure and expertise in global employment solutions, clients maintain their core business relationships and workplace culture. This balanced partnership enables organizations to:

As co-stewards of your global workforce, we ensure mutual understanding of responsibilities, creating a transparent framework for success. This partnership model allows your team to focus on growth while working alongside our employment solutions specialists to maintain compliant operations.

Through clear communication and defined responsibilities, we build sustainable global employment partnerships that support your international business objectives while effectively managing shared compliance obligations.

Strategic Global Employment Partnership

Partner with an Employer of Record (EOR) to confidently expand your international workforce. Our collaborative approach combines your business expertise with our global employment solutions, creating a balanced framework for success.

Together, we manage:

While we provide compliance infrastructure, you maintain control of your business operations, company culture, and team management. This partnership lets you focus on growth while ensuring compliant global employment practices through shared responsibility and clear protocols.

Streamlined Global Payroll Partnership

Partner with an Employer of Record (EOR) to optimize your international payroll operations. Our collaborative approach pairs your business knowledge with our payroll expertise, ensuring accurate and timely compensation across borders.

Together, we coordinate:

While we provide payroll infrastructure and expertise, you maintain oversight of your compensation strategy and business decisions. This shared approach helps prevent processing errors and compliance gaps, enabling efficient global workforce management.

Remote Workforce Excellence Through Partnership

Partner with an Employer of Record (EOR) to build and sustain your global remote teams. Our collaborative approach combines your company vision with our international employment expertise, creating seamless remote work solutions.

Together, we facilitate:

While we provide the employment infrastructure, you drive your workplace culture and team development. This partnership enables compliant remote workforce expansion without establishing local entities, sharing responsibility for remote team success.

Strategic Immigration Partnership for Global Talent

Partner with an Employer of Record (EOR) to navigate international worker mobility. Our collaborative approach combines your hiring strategy with our immigration expertise, streamlining visa and work permit processes.

Together, we coordinate:

While we provide immigration infrastructure and expertise, you maintain control of your talent selection and business strategy. This shared approach can allow for compliant international hiring, enabling confident workforce expansion across borders.

Secure Data Management Partnership

Partner with an Employer of Record (EOR) to strengthen your employee data protection practices. Our collaborative approach combines your business processes with our data protection expertise, meeting global privacy standards like GDPR and CCPA.

Together, we maintain:

While we provide data protection infrastructure, you retain control of your internal systems and processes. This shared commitment to security creates robust employee data management across jurisdictions.

Worker Classification Partnership

Partner with an Employer of Record (EOR) to strengthen your employment practices. Our collaborative approach combines your business needs with our classification expertise, following local worker status regulations.

Together, we establish:

While we provide classification guidance and infrastructure, you maintain control of your workforce strategy. This shared approach helps prevent misclassification challenges and creates sustainable employment practices.

Another advantage is cost efficiency. By teaming up with an Employer of Record to handle tasks like payroll, benefits administration, and tax filings, companies can reduce administrative burdens and operational costs. This support is particularly helpful for small and medium-sized enterprises (SMEs) that may not have the resources to manage these responsibilities in-house. Additionally, the EOR facilitates faster expansion by enabling businesses to hire workers in new markets without needing to establish a local entity, saving time and reducing the complexities of setting up foreign subsidiaries.

The Employer of Record also provides risk mitigation by guiding businesses through employee classifications and managing potential disputes. This reduces the risks associated with worker misclassification and ensures compliance with local laws. By working alongside an EOR, companies can focus on strategic growth and core operations while receiving assistance with day-to-day HR and compliance tasks, ensuring smooth and efficient workforce management across multiple regions.

Additionally, an Employer of Record supports small businesses by helping them navigate compliance with local labor laws, which can be especially challenging for companies with limited legal or HR resources. By providing guidance on payroll, taxes, and benefits, the Employer of Record ensures businesses remain compliant with local regulations, reducing the risk of legal disputes or fines that could impact a smaller company’s financial stability.

By teaming up with an EOR, small businesses can focus more on their core operations and growth strategies. This flexible partnership allows them to respond quickly to new market opportunities. Furthermore, the Employer of Record provides access to HR expertise and resources that might otherwise be out of reach for small businesses, helping them attract and retain top talent in both new domestic markets and international locations.

Employer of Record services are invaluable across all industries, especially for those that rely on a global or remote workforce. For instance, technology companies benefit greatly as they hire software developers, engineers, and IT specialists in multiple countries. This allows them to tap into a global talent pool without establishing a physical presence in each location, providing the flexibility crucial for rapid scaling and market expansion.

In the healthcare industry, Employer of Record services are essential for hiring medical coders, researchers, and administrative staff across different regions. They ensure compliance with stringent local labor laws and regulations, reducing risks of non-compliance in an industry where regulatory scrutiny is intense.

Industries like finance, consulting, education, and non-profits also reap significant benefits from Employer of Record services when they seek to expand internationally. These sectors often require specialized talent and must navigate various local regulations, making the comprehensive employment solutions offered by Employ of Records indispensable.

Ultimately, no matter the industry, leveraging Employer of Record services allows companies to focus on their core missions while expertly managing the complexities of international employment, making it a strategic advantage for any business aiming to operate globally.

An Employer of Record helps businesses foster an inclusive and supportive work environment, enhancing employee morale and engagement across different cultural contexts. By teaming up with an Employer of Record, companies can access training and resources to promote cultural sensitivity, helping employees understand and respect diverse backgrounds. The EOR provides guidance on implementing localized HR practices that align with regional customs and expectations, ensuring employees feel valued and respected in their unique cultural settings.

An Employer of Record also supports clear communication and bridges language barriers, ensuring all employees are informed and engaged, regardless of their location. By promoting inclusive workplace policies that embrace cultural diversity and encourage collaboration, they help create a cohesive and productive workforce. With access to local HR professionals who understand regional nuances, businesses can rely on the EOR to assist in maintaining a positive and supportive environment. This partnership often leads to improved morale, higher engagement, and stronger retention rates across a global workforce.

Another advantage is cost efficiency. By teaming up with an Employer of Record to handle tasks like payroll, benefits administration, and tax filings, companies can reduce administrative burdens and operational costs. This support is particularly helpful for small and medium-sized enterprises (SMEs) that may not have the resources to manage these responsibilities in-house. Additionally, the EOR facilitates faster expansion by enabling businesses to hire workers in new markets without needing to establish a local entity, saving time and reducing the complexities of setting up foreign subsidiaries.

The Employer of Record also provides risk mitigation by guiding businesses through employee classifications and managing potential disputes. This reduces the risks associated with worker misclassification and ensures compliance with local laws. By working alongside an EOR, companies can focus on strategic growth and core operations while receiving assistance with day-to-day HR and compliance tasks, ensuring smooth and efficient workforce management across multiple regions.

Additionally, an Employer of Record supports small businesses by helping them navigate compliance with local labor laws, which can be especially challenging for companies with limited legal or HR resources. By providing guidance on payroll, taxes, and benefits, the Employer of Record ensures businesses remain compliant with local regulations, reducing the risk of legal disputes or fines that could impact a smaller company’s financial stability.

By teaming up with an EOR, small businesses can focus more on their core operations and growth strategies. This flexible partnership allows them to respond quickly to new market opportunities. Furthermore, the Employer of Record provides access to HR expertise and resources that might otherwise be out of reach for small businesses, helping them attract and retain top talent in both new domestic markets and international locations.

Employer of Record services are invaluable across all industries, especially for those that rely on a global or remote workforce. For instance, technology companies benefit greatly as they hire software developers, engineers, and IT specialists in multiple countries. This allows them to tap into a global talent pool without establishing a physical presence in each location, providing the flexibility crucial for rapid scaling and market expansion.

In the healthcare industry, Employer of Record services are essential for hiring medical coders, researchers, and administrative staff across different regions. They ensure compliance with stringent local labor laws and regulations, reducing risks of non-compliance in an industry where regulatory scrutiny is intense.

Industries like finance, consulting, education, and non-profits also reap significant benefits from Employer of Record services when they seek to expand internationally. These sectors often require specialized talent and must navigate various local regulations, making the comprehensive employment solutions offered by Employ of Records indispensable.

Ultimately, no matter the industry, leveraging Employer of Record services allows companies to focus on their core missions while expertly managing the complexities of international employment, making it a strategic advantage for any business aiming to operate globally.

An Employer of Record helps businesses foster an inclusive and supportive work environment, enhancing employee morale and engagement across different cultural contexts. By teaming up with an Employer of Record, companies can access training and resources to promote cultural sensitivity, helping employees understand and respect diverse backgrounds. The EOR provides guidance on implementing localized HR practices that align with regional customs and expectations, ensuring employees feel valued and respected in their unique cultural settings.

An Employer of Record also supports clear communication and bridges language barriers, ensuring all employees are informed and engaged, regardless of their location. By promoting inclusive workplace policies that embrace cultural diversity and encourage collaboration, they help create a cohesive and productive workforce. With access to local HR professionals who understand regional nuances, businesses can rely on the EOR to assist in maintaining a positive and supportive environment. This partnership often leads to improved morale, higher engagement, and stronger retention rates across a global workforce.

Our VIBES initiative sets us apart from traditional Employers of Record by prioritizing community engagement, investment, and social responsibility.

A positive culture within your contingent workforce fosters higher morale, increased productivity, and ultimately, more profitable outcomes. Simply put, our teams work harder for you.

Germany

Creating a global workforce is a continuous process that's more than a contract, its people. TCWGlobal takes employer of record (EOR) from a transaction to a relationship! We're here to make that process simple and joyful!

Australia

Bangladesh

Canada

Chile

Germany

Indonesia

Lithuania

Malaysia

Mexico

Nicaragua

Peru

Serbia

Singapore

Taiwan

Turkey

Uganda

Vietnam

Australia

Bangladesh

Canada

Chile

Germany

Indonesia

Lithuania

Malaysia

Mexico

Nicaragua

Peru

Serbia

Singapore

Taiwan

Turkey

Uganda

Vietnam

Nicaragua

Peru

Serbia

Singapore

Taiwan

Turkey

Uganda

Vietnam

Nicaragua

Peru

Serbia

Singapore

Taiwan

Turkey

Uganda

Vietnam

We offer Medical, Dental and Vision with options for any individual and family.

We have an onsite gym and offer annual discounts on fitness memberships.

We match our employees annual donations up to $5000 to 501(c)(3) organizations.

Adopt a new fur baby from a non profit and we'll give you $100! All that money can go to treats!

Good grades are still a good thing and through our internship program, students can get some great TCW Swag!

Employer of Record services are also valuable when managing a remote workforce spread across multiple jurisdictions. If your company has a distributed team, the Employer of Record can assist with payroll, benefits, and compliance for employees in different locations. This reduces the administrative burden on your internal HR team while ensuring all employees receive consistent support and are managed in line with local regulations.

Additionally, Employer of Record services are ideal for businesses undertaking temporary projects or short-term assignments in new locations. Whether you need to bring on specialists for a specific project or expand your workforce temporarily to meet increased demand, the EOR provides a flexible solution that allows you to hire and manage employees legally without the long-term commitment or cost of establishing a local entity.

Choosing between opening a local entity or partnering with an Employer of Record depends on your business’s needs, resources, and long-term strategy. Establishing a local entity offers more control over operations and can be cost-effective in the long term if you plan to maintain a significant, sustained presence in a new market. However, this process can be time-intensive, expensive, and requires a thorough understanding of local laws and regulations, which can be challenging, especially for small and medium-sized businesses.

Alternatively, teaming up with an Employer of Record is a more practical option for businesses looking to expand quickly or test new markets without taking on the complexities of setting up a local entity. An EOR provides assistance with employment responsibilities such as payroll, tax compliance, employee benefits, and HR tasks, enabling your company to avoid the administrative burdens and costs of establishing a new entity. This is particularly beneficial for businesses with limited resources or those aiming to maintain a lean operational model.

In summary, an Employer of Record is ideal for short-term needs, remote workforce management, or initial market entry, while opening a local entity may be better suited for businesses planning a long-term, substantial presence in a specific country. Companies should carefully consider their costs, benefits, and strategic goals to determine the most suitable approach.

When selecting an Employer of Record, it’s important to consider their experience and expertise in the regions where you plan to hire. Partnering with an Employer of Record that has a strong presence and deep understanding of your target markets can provide valuable guidance on local labor laws, cultural nuances, and employment practices. This ensures compliance and facilitates smooth operations as your business grows.

Another key factor is the range of services offered. While many Employers of Record provide payroll and compliance support, some also assist with recruitment, employee training, and performance management. Depending on your needs, you may want a partner that offers comprehensive HR solutions to enhance your in-house capabilities. Additionally, it’s important to evaluate their technological tools, such as payroll systems and employee self-service platforms, to ensure they meet your operational requirements.

Finally, consider their customer support and communication practices. A dependable EOR should provide responsive assistance and maintain open communication to address concerns promptly. Reviewing client testimonials, seeking references, and assessing their reputation can help you determine the quality of their service. The right Employer of Record is one that aligns with your business objectives, provides the support you need, and adapts to your evolving requirements.

Scalability and flexibility are also critical considerations. The Employer of Record should have the capacity to scale services up or down based on the corporation’s expansion plans or market needs. They should also provide tailored solutions to meet the specific requirements of different departments or business units, ensuring alignment with the company’s strategic goals and adaptability to changing conditions.

Additionally, technological integration and data security are essential factors. Multinational corporations need seamless integration between the EOR’s systems and their internal HR and payroll platforms to maintain operational efficiency. Strong data protection and compliance with global privacy regulations, such as GDPR or CCPA, are vital to safeguarding employee information across borders. The ideal EOR will offer advanced technology solutions, prioritize data security, and ensure compliance with international standards, providing the support needed for successful global operations.

Employer of Record services are also valuable when managing a remote workforce spread across multiple jurisdictions. If your company has a distributed team, the Employer of Record can assist with payroll, benefits, and compliance for employees in different locations. This reduces the administrative burden on your internal HR team while ensuring all employees receive consistent support and are managed in line with local regulations.

Additionally, Employer of Record services are ideal for businesses undertaking temporary projects or short-term assignments in new locations. Whether you need to bring on specialists for a specific project or expand your workforce temporarily to meet increased demand, the EOR provides a flexible solution that allows you to hire and manage employees legally without the long-term commitment or cost of establishing a local entity.

Choosing between opening a local entity or partnering with an Employer of Record depends on your business’s needs, resources, and long-term strategy. Establishing a local entity offers more control over operations and can be cost-effective in the long term if you plan to maintain a significant, sustained presence in a new market. However, this process can be time-intensive, expensive, and requires a thorough understanding of local laws and regulations, which can be challenging, especially for small and medium-sized businesses.

Alternatively, teaming up with an Employer of Record is a more practical option for businesses looking to expand quickly or test new markets without taking on the complexities of setting up a local entity. An EOR provides assistance with employment responsibilities such as payroll, tax compliance, employee benefits, and HR tasks, enabling your company to avoid the administrative burdens and costs of establishing a new entity. This is particularly beneficial for businesses with limited resources or those aiming to maintain a lean operational model.

In summary, an Employer of Record is ideal for short-term needs, remote workforce management, or initial market entry, while opening a local entity may be better suited for businesses planning a long-term, substantial presence in a specific country. Companies should carefully consider their costs, benefits, and strategic goals to determine the most suitable approach.

When selecting an Employer of Record, it’s important to consider their experience and expertise in the regions where you plan to hire. Partnering with an Employer of Record that has a strong presence and deep understanding of your target markets can provide valuable guidance on local labor laws, cultural nuances, and employment practices. This ensures compliance and facilitates smooth operations as your business grows.

Another key factor is the range of services offered. While many Employers of Record provide payroll and compliance support, some also assist with recruitment, employee training, and performance management. Depending on your needs, you may want a partner that offers comprehensive HR solutions to enhance your in-house capabilities. Additionally, it’s important to evaluate their technological tools, such as payroll systems and employee self-service platforms, to ensure they meet your operational requirements.

Finally, consider their customer support and communication practices. A dependable EOR should provide responsive assistance and maintain open communication to address concerns promptly. Reviewing client testimonials, seeking references, and assessing their reputation can help you determine the quality of their service. The right Employer of Record is one that aligns with your business objectives, provides the support you need, and adapts to your evolving requirements.

Scalability and flexibility are also critical considerations. The Employer of Record should have the capacity to scale services up or down based on the corporation’s expansion plans or market needs. They should also provide tailored solutions to meet the specific requirements of different departments or business units, ensuring alignment with the company’s strategic goals and adaptability to changing conditions.

Additionally, technological integration and data security are essential factors. Multinational corporations need seamless integration between the EOR’s systems and their internal HR and payroll platforms to maintain operational efficiency. Strong data protection and compliance with global privacy regulations, such as GDPR or CCPA, are vital to safeguarding employee information across borders. The ideal EOR will offer advanced technology solutions, prioritize data security, and ensure compliance with international standards, providing the support needed for successful global operations.

When choosing an Employer of Record (EOR) service, people often make mistakes such as overlooking compliance, global reach, technology integration, company experience, and fee transparency. Watch this video to see what to consider when picking an EOR.

An Employer of Record provides a flexible alternative, allowing companies to avoid these setup and maintenance costs. By working alongside businesses, the Employer of Record supports all employment-related tasks, including payroll, taxes, benefits, and compliance, through a simplified, consolidated fee structure. While service fees may seem higher on a per-employee basis, they often prove more economical when factoring in the avoided costs of establishing and maintaining a local entity. For companies seeking a practical and cost-efficient way to enter new markets or manage international teams, an Employer of Record offers an adaptable and financially viable solution.

An EOR provides a streamlined and cost-effective alternative by consolidating all these functions into a single service. With a flat fee per employee, an Employer of Record supports payroll, benefits administration, and compliance without the overhead of maintaining a full in-house HR team. Beyond being cost-efficient, an Employer of Record helps businesses expand faster, bypassing the lengthy process of setting up a legal entity or establishing local HR operations.

By teaming up with an Employer of Record, companies can reduce administrative burdens, lower HR costs, and accelerate their entry into new markets—all while ensuring compliance with local labor laws.

An EOR provides a flexible alternative, allowing companies to bypass these initial setup costs and avoid the ongoing expenses of maintaining a local entity. By teaming up with an Employer of Record, businesses can consolidate employment-related functions such as payroll, taxes, benefits, and compliance into a single, streamlined service. While service fees may appear higher on a per-employee basis, they often prove more economical when factoring in the avoided costs and complexities of setting up a legal entity.

In the long term, an Employer of Record also helps companies save money by reducing the need for a large in-house HR team to manage compliance, benefits, and payroll across multiple regions. By providing guidance and support to streamline these functions, the Employer of Record helps businesses reduce overhead costs while maintaining efficient operations. For companies seeking both immediate and sustained cost savings, partnering with an Employer of Record offers a practical and financially sound approach to expanding into new markets and managing international teams.

An Employer of Record provides a flexible alternative, allowing companies to avoid these setup and maintenance costs. By working alongside businesses, the Employer of Record supports all employment-related tasks, including payroll, taxes, benefits, and compliance, through a simplified, consolidated fee structure. While service fees may seem higher on a per-employee basis, they often prove more economical when factoring in the avoided costs of establishing and maintaining a local entity. For companies seeking a practical and cost-efficient way to enter new markets or manage international teams, an Employer of Record offers an adaptable and financially viable solution.

An EOR provides a streamlined and cost-effective alternative by consolidating all these functions into a single service. With a flat fee per employee, an Employer of Record supports payroll, benefits administration, and compliance without the overhead of maintaining a full in-house HR team. Beyond being cost-efficient, an Employer of Record helps businesses expand faster, bypassing the lengthy process of setting up a legal entity or establishing local HR operations.

By teaming up with an Employer of Record, companies can reduce administrative burdens, lower HR costs, and accelerate their entry into new markets—all while ensuring compliance with local labor laws.

An EOR provides a flexible alternative, allowing companies to bypass these initial setup costs and avoid the ongoing expenses of maintaining a local entity. By teaming up with an Employer of Record, businesses can consolidate employment-related functions such as payroll, taxes, benefits, and compliance into a single, streamlined service. While service fees may appear higher on a per-employee basis, they often prove more economical when factoring in the avoided costs and complexities of setting up a legal entity.

In the long term, an Employer of Record also helps companies save money by reducing the need for a large in-house HR team to manage compliance, benefits, and payroll across multiple regions. By providing guidance and support to streamline these functions, the Employer of Record helps businesses reduce overhead costs while maintaining efficient operations. For companies seeking both immediate and sustained cost savings, partnering with an Employer of Record offers a practical and financially sound approach to expanding into new markets and managing international teams.

Partnering with an Employer of Record (EOR) is crucial to ensure legal compliance, mitigate risks, and streamline your global expansion, allowing you to focus on your core business and achieve unprecedented success.

Choosing us as your Employer of Record service provider is a smart move for your business.

When we manage your payrolling, our advanced, reliable technology comes at no cost to you.

Our friendly and knowledgeable sales team is ready to discuss this further with you. Give them a call; after all, improving your processes and saving money is a win-win for your business.

Transitioning to Employer of Record services requires thoughtful planning to ensure a seamless integration. This section outlines the key steps for transitioning to an Employer of Record, highlights common challenges when shifting from a traditional HR model, and provides strategies for managing remote and hybrid teams across multiple time zones. Additionally, it covers practical tips for addressing payroll discrepancies effectively when collaborating with an Employer of Record. Explore these insights to ensure a smooth and successful transition while optimizing your workforce management processes.

Transitioning to Employer of Record services typically starts with selecting a provider that aligns with your business needs and geographical requirements. Once an Employer of Record is chosen, the next step involves assessing your current workforce and preparing for the transition. This includes reviewing and aligning employment contracts, setting up payroll systems, and ensuring employee benefits meet local regulations. The Employer of Record supports this process by guiding employee onboarding, contract management, and compliance with local labor laws.

During the transition, the Employer of Record takes on responsibilities such as payroll processing, tax compliance, benefits administration, and other employment-related tasks. Meanwhile, your company continues to oversee day-to-day operations and manage employee performance. Maintaining open communication between your team and the EOR is essential to address any challenges and ensure a seamless transition. This partnership allows you to focus on core business activities while the Employer of Record handles the complexities of compliance and administration.

Employer of Record services support businesses in managing remote and hybrid workforces by providing assistance with HR and administrative tasks, ensuring compliance with local labor laws no matter where employees are located. An Employer of Record supports you in handling payroll, taxes, and benefits across multiple jurisdictions, simplifying global operations without the need to establish local entities. This centralized approach ensures consistent HR practices and compliance, which is particularly valuable for managing teams across different time zones and remote work arrangements.

Additionally, an Employer of Record often provides tools and resources to enhance communication and collaboration among remote teams. They assist with onboarding, training, and performance management, offering tailored support to meet the unique needs of remote and hybrid workforces. By providing localized guidance and resources, an Employer of Record helps businesses maintain productivity and employee satisfaction, addressing the challenges of managing a global workforce spread across diverse locations.

By joining forces with an EOR, businesses can streamline HR operations, including payroll processing, benefits administration, and contract management, across multiple regions. EORs provide you with expert guidance on compliance, offering tools and resources that support efficient workforce management. This collaboration allows you to focus on scaling your business while reducing the risk of non-compliance penalties. While an EOR supports you with compliance-related tasks, your organization is ultimately accountable for implementing fair and lawful policies, ensuring a balanced approach to managing global teams.

Leverage our global employer of record services to efficiently manage your worldwide workforce, ensuring seamless operations and adherence to local laws and regulations while you focus on what truly matters - growing your business.

For example, if you're looking for Employer of Record services in these key markets, it's important to verify the provider's coverage:

TCWGlobal offers Employer of Record services in 150+ countries, ensuring your international expansion is smooth and well-supported across a wide range of locations.

When negotiating contracts with Employer of Record providers, it’s crucial to have a clear understanding of the scope of services and associated fees. Ensure the contract explicitly outlines all services, such as payroll processing, benefits administration, and compliance management, to avoid unexpected charges for tasks like employee onboarding or termination. A common oversight is underestimating costs beyond the per-employee fees. Some providers may not fully disclose that companies are responsible for covering employer taxes in the employee's jurisdiction, which can significantly impact the total cost.

To avoid surprises, it’s important to work with a provider that values transparency in disclosing all potential expenses upfront. For a clear breakdown of costs, including employer taxes, TCWGlobal offers detailed and straightforward quotes, helping companies effectively plan and manage their budgets without hidden fees.

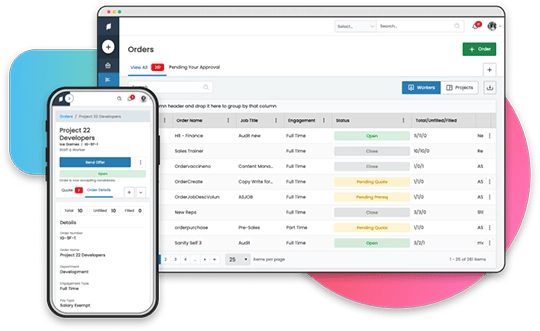

A critical consideration when choosing an Employer of Record is the technology they offer. TCWGlobal provides its proprietary platform, which streamlines payroll, benefits, and compliance management while ensuring robust data security. Designed for efficiency and transparency, TCWGlobal’s platform supports seamless operations for businesses expanding into international markets. With a proven track record of reliable and efficient support, TCWGlobal stands out as a dependable partner for businesses looking to navigate global workforce management.

For example, if you're looking for Employer of Record services in these key markets, it's important to verify the provider's coverage:

TCWGlobal offers Employer of Record services in 150+ countries, ensuring your international expansion is smooth and well-supported across a wide range of locations.

When negotiating contracts with Employer of Record providers, it’s crucial to have a clear understanding of the scope of services and associated fees. Ensure the contract explicitly outlines all services, such as payroll processing, benefits administration, and compliance management, to avoid unexpected charges for tasks like employee onboarding or termination. A common oversight is underestimating costs beyond the per-employee fees. Some providers may not fully disclose that companies are responsible for covering employer taxes in the employee's jurisdiction, which can significantly impact the total cost.

To avoid surprises, it’s important to work with a provider that values transparency in disclosing all potential expenses upfront. For a clear breakdown of costs, including employer taxes, TCWGlobal offers detailed and straightforward quotes, helping companies effectively plan and manage their budgets without hidden fees.

A critical consideration when choosing an Employer of Record is the technology they offer. TCWGlobal provides its proprietary platform, which streamlines payroll, benefits, and compliance management while ensuring robust data security. Designed for efficiency and transparency, TCWGlobal’s platform supports seamless operations for businesses expanding into international markets. With a proven track record of reliable and efficient support, TCWGlobal stands out as a dependable partner for businesses looking to navigate global workforce management.

Unleash global talent with our hassle-free employer of record and staffing services.

Tap into global talent effortlessly. As the employer of record, we handle liability, governance, and compliance. Say goodbye to administrative burdens. Contact us now.

TCWGlobal has many benefits designed especially for managing interns. We can also support remote intern and co-op programs in the U.S. and overseas.