Pay Transparency Could Cost You - Is Your Company Ready?

March 9, 2023

Is Your Company Breaking the Law? Failing to comply with the new Pay Transparency law Could Cost You Thousands in Fines!

As the topic of pay transparency dominates the headlines, our unwavering commitment to our clients has led us to integrate cutting-edge features into our StaffingNation software, providing unparalleled transparency, compliance, and accuracy in pay management.

Here's a quick primer if you still need to familiarize yourself with the new pay transparency laws and why they matter.

What is Pay Transparency?

Pay transparency refers to the practice of disclosing information about worker compensation, such as salaries, wages, and benefits, either to individual workers or to the public. It can take many forms, including making salary ranges public, providing individual workers with detailed information about their own pay and benefits, or allowing workers to discuss their pay with each other without fear of retaliation.

What is the purpose of the Pay Transparency Law?

Pay transparency laws are aimed at increasing fairness and equity in the workplace by letting workers know if they are being paid fairly for their work and helping companies identify and correct any potential wage disparities.

This can also help to improve worker morale and productivity by increasing trust and transparency between workers and their companies.

Does the new Pay Transparency Law also include contractors and temporary workers?

To make sure you're fully protected when it comes to the new pay transparency law, it's definitely best to make sure that you include temporary workers and contractors as well as regular employees. The law requires companies to provide pay scale information to all job applicants for positions, regardless of whether they are temporary workers or contractors.

What is the penalty for failing to comply with the Pay Transparency Law?

If companies fail to include pay ranges in their job postings in California, workers have the option to file a lawsuit or a complaint with the Labor Commissioner's Office, which may result in a penalty ranging from $100 to $10,000 per violation.

To avoid potential issues, companies that have not created pay ranges for their current positions should establish them, and they should also ensure that there are no pay discrepancies based on protected characteristics such as race, sex, or other similar factors amongst their workforce who perform substantially similar work. Additionally, they should take measures to include pay ranges in job postings that are remote or in locations with these posting requirements.

Get the Peace of Mind You Need with Pay Transparency Compliance

It's essential that TCWGlobal keeps up with current trends and regulations to serve our clients best. One recent legal requirement, in certain locations – not all, is that companies provide job applicants with a salary range either in the job posting or upon request. To see if your state requires pay transparency, contact our global support team.

To meet this requirement, we've developed new features within StaffingNation that will streamline the process.

As we have done for the past 15 years, we're committed to ensuring our clients stay up-to-date and compliant with all the latest regulations.

"Staying up to date with new laws isn't just an obligation, it's a responsibility we owe to our clients. It ensures they can operate with compliance and confidence."

- Samer Khouli CEO, TCWGlobal

Here's How Our Software Makes It Effortless to Manage Pay Transparency

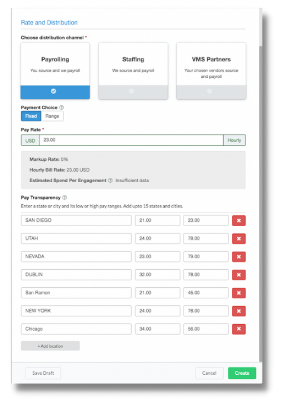

Order Level

We have now created the ability for the client to add up to 15 state or city-specific pay ranges at the order level (staffing or payrolling).

This is an optional feature, so clients aren't required to enter ranges.

However, the feature (especially where the team is performing the staffing or managing of VMS Orders) will:

- Reduce any back-and-forth between the client and the recruiter.

- Make specific posting requirements are appropriately met.

- And allow TCW the visibility to address any applicant specific inquiries during the offer stage to reduce any delays in onboarding.

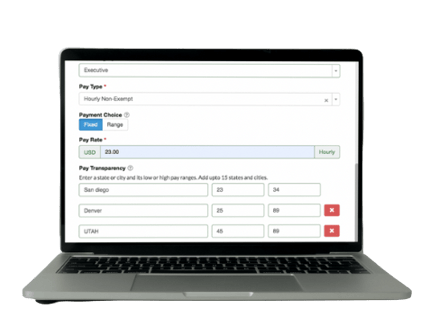

Job Description Level

Our second feature change made is related to creating job descriptions. We previously had a pay range field, but it was limited to one single range.

StaffingNation can now be addressed for up to 15 locations as well.

We have seen some clients wanting to list their pay bands as part of the JDs for numerous reasons:

- Firstly, often the JDs are used in job postings, so it is easy to maintain compliance.

- Secondly, this does allow a level of transparency that reduces some of the candidate and worker inquiries.

- Thirdly, it can help maintain consistency in the utilization of pay bands regardless of the hiring manager.

Reporting Features in Webcenter:

The California Civil Rights Department ("CRD") has also created new reporting obligations for clients that utilize contract labor.

The deadline for 2023 filing will be May 10, 2023.

TCWGlobal is prepared and has created self-service reports available through Webcenter that will provide our clients with the information they need to file their Labor Contractor Employee Report.

What Clients will this be applicable to?

- Private companies with 100 or more labor contractor workers within the prior calendar year if there is also at least one labor contractor employee in California.

- Entities with fewer than 100 labor contractor workers only report if part of an "integrated enterprise" and enterprise has more than 100 labor contractor workers in total.

- The FAQs clarify that the 100+ employee threshold is determined based on number of labor contractor workers in the Snapshot period (across all of its different EOR or Staffing Agencies) or employed on a "regular basis" (generally related to industries that do not have a typical 12-month work cycle).

What Workers must be included on this report?

The FAQs released (which can be found at https://calcivilrights.ca.gov/paydatareporting/faqs/ make it clear the report needs to include not only those labor contractor workers that work in CA but also all those outside of CA that are assigned to an establishment in CA.

Where to find the reports?

Through Webcenter, clients can utilize the following reports:

- Pay Transparency Report: Counts by Pay Band

- Pay Transparency Report: Pay Range Info

.png?width=491&height=399&name=Screen_Shot_2023-03-09_at_4.38.37_PM-removebg-preview%20(1).png)

Conclusion and Next Steps:

TCWGlobal, through its proprietary contingent workforce platform StaffingNation, as always, is on top of new legislation. And we're dedicated to providing our clients with the most up-to-date information and tools to ensure they meet all the new laws and regulations.

Contact our global support team at 858-810-3000 or email us at hello@tcwglobal.com to get answers to your questions.